do you pay tax on a leased vehicle

And pictures and video. At the very least you have likely already paid some sales tax on the car so its highly unlikely you need to pay taxes on the complete original price of the leased car.

First-ever 4000 tax credit for used electric vehicles and 7500 for new gets OK from Congress.

. In the United States vehicle registration plates known as license plates are issued by a department of motor vehicles an agency of the state or territorial government or in the case of the District of Columbia the district government. Tax Accounting. Is the seller the registered keeper shown on the V5C.

The standard tax. Heavy highway vehicle use tax. Vehicle insurance in the United States also known as car insurance or auto insurance is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damageMost states require a motor vehicle owner to carry some minimum level of liability insurance.

Research and compare vehicles find local dealers calculate loan payments find your car. You may have to subtract an inclusion amount from your deduction to account for depreciation. Returning your leased car.

Some prepandemic leasing contracts allow you to trade your leased vehicle at any dealership. Your annual vehicle registration payment consists of various fees that apply to your vehicle. If not why are they selling it for someone else.

Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. The empty string is the special case where the sequence has length zero so there are no symbols in the string. Federal government issues plates only for its own vehicle fleet and for vehicles owned.

Based on the number of miles you drive per year you may qualify for a discount. The tax applies to highway motor vehicles with a. Vehicle Depreciation Could Weigh.

If you feel sure its safe to leave the vehicle do so through the left-hand door and stand well clear of the vehicle and moving traffic. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee. When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle.

The lease sets a maximum. You may trade in your leased or financed car if your lessor or bank allows it. Vehicle License Fee may be an income tax.

This guide is not designed to address all questions which may arise nor to address complex issues in detail. In this case paying for gap insurance may be worth it. Details of breakdowns call outs and claims made by you your policy holders or policy beneficiaries and product eligibility such as whether you have an up-to-date MOT up-to-date tax or whether your vehicle is listed as being off the road or you provided the DVLA with a Statutory Off Road Notification SORN.

If you rented or leased vehicles machinery or equipment enter on line 20a the business portion of your rental cost. The lease contract is not subject to tax. Expert reviews of cars trucks crossovers and SUVs.

The buyer can then register the car and pay sales tax at. Rental of vehicles machinery or equipment goes on Line 20a. With vehicle tax and breakdown cover included its the simple way to drive a brand-new car.

This income inclusion rule is an attempt to equalize the tax benefits from leasing and owning business vehicles. Formally a string is a finite ordered sequence of characters such as letters digits or spaces. Line 21 covers any costs incurred in repairing or maintaining your machinery.

If you choose to pay your tax preparation fee with TurboTax using your. Can I trade in my leased or financed car. The Vehicle License Fee is the portion that may be an income tax deduction and is what is displayed.

Get the ins and outs on paying the motor vehicle excise tax to your city or town hall. You report the federal excise tax on the use of certain trucks truck tractors and buses used on public highways on Form 2290 Heavy Highway Vehicle Use Tax Return. In most cases you can sell your leased vehicle to CarMax in almost the same way as any other financed car according to the company.

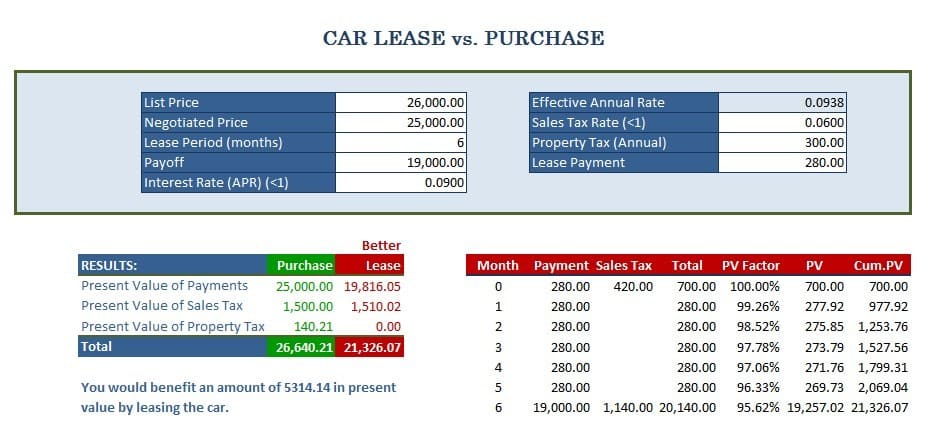

This is the number of months you agree to lease the car. Section 179 deduction dollar limits. Returning your leased car.

This is negotiated with the dealer as with a vehicle purchase. Do I owe tax if I bring a leased motor vehicle into Texas from another state. Your renewal notice and registration card itemize these fees in the following categories.

The business mileage rate for 2022 is 585 cents per mile. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. If youre in an accident whether its your fault or not you are responsible for the repairs not the leasing company.

With vehicle tax and breakdown cover included its the simple way to drive a brand-new car. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. Tesla will pay off the balance of your current car after the delivery of your Tesla.

If the accident is. But if you have a 30000 car loan on a 22000 car you might not be able to afford to pay the 8000 gap. But if you leased a vehicle for a term of 30 days or more you may have to reduce your deduction by an amount called the inclusion amount.

You will need to provide a settlement letter valid for 14 days after your new vehicles Scheduled Delivery Date. Length of the lease. You wont be able to tax the car without it.

When you store your vehicle you can save up to 60 on your auto insurance. However see IRS Publication 463 if you leased a vehicle for more than 30 days. Nothing contained herein supersedes alters or otherwise changes any provision of the.

Autoblog brings you car news. When the value of the leased vehicle is above a certain amount you must also subtract an income inclusion amount from the deductible amount of your lease. If its the other drivers fault shell need to have her insurance pay for it but you will arrange for the repairs.

463 to figure this amount. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. When you register your motor vehicle or trailer you have to pay a motor vehicle and trailer excise.

Some Native American tribes also issue plates. See Leasing a Car in chapter 4 of Pub.

Car Leasing Costs Taxes And Fees U S News

Chevy Lease Specials Lafontaine Chevrolet Dealer

Are There Tax Advantages To Leasing A Car Under Your Business

Tax Deductions And Business Vehicle Leasing Veturilo

Lease Return Center Nucar Ford Of Plymouth

Understanding Lease Buyout Auto Loans

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

What 0 Down When Leasing A Car Really Means Bmw Of Wyoming Valley

Tax Advantage Leasing Vs Buying Lancaster Toyota

Leasing A Car Consumer Business

Understanding Tax On A Leased Car Capital One Auto Navigator

How Is Sales Tax Calculated On A Car Lease In California Quora

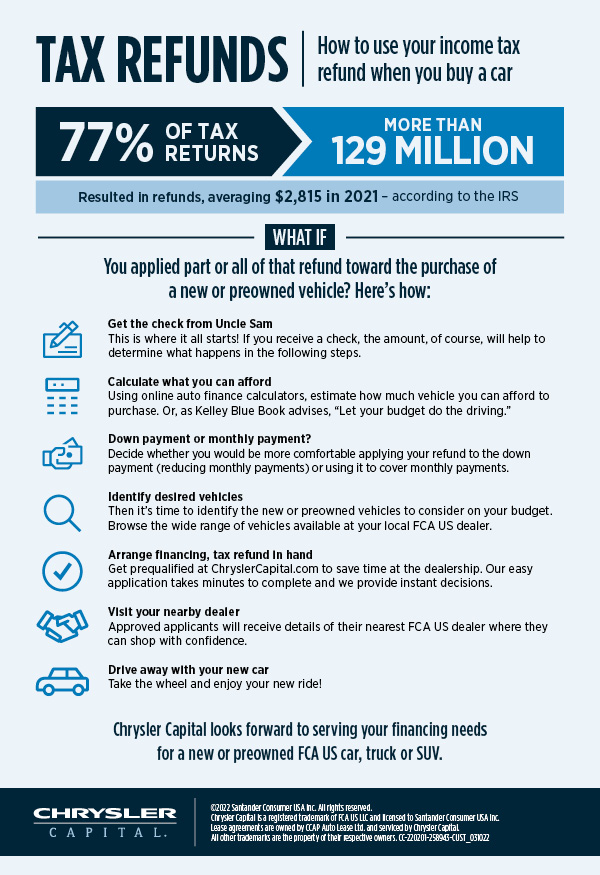

How To Optimize Your Tax Refund When You Buy Or Lease A Car Chrysler Capital

Is It Better To Lease Or Buy A New Car Forbes Wheels

How To Calculate Sales Tax On Leased Vehicles